For investors waiting until the price of office buildings in Los Angeles drops to bedrock, the time may have arrived. A recent smattering of sales points to a new price floor for office buildings in the market.

“There’s some comfort level that you’re buying near the bottom,” said Kevin Shannon at Newmark, one of the most prominent investment sales brokers across the West Coast.

“There’s a lot more capital looking for deals,” Shannon said, an observation borne out by a spate of sales that came in the final days of 2023.

In December, three office properties across Los Angeles sold, each in a different segment of Greater L.A.’s sprawl.

First, Kennedy Wilson sold 400 and 450 North Brand Boulevard in Glendale for $60 million, or $136 per square foot. Next, Carolwood bought the AON Center, a Downtown Los Angeles office tower, for about $134 a square foot. And lastly, Harbor Associates bought 1640 South Sepulveda Boulevard in Westwood for $271 a foot.

Each deal was a drastic haircut compared to its last sale — between 50 and 60 percent.

Some investors and brokers are starting to think those prices are as low as they will go — and that the floor will be there for a while. Indeed, Shannon said there’s still going to be some “ugly comps,” with more transactions are set to close over the next few months.

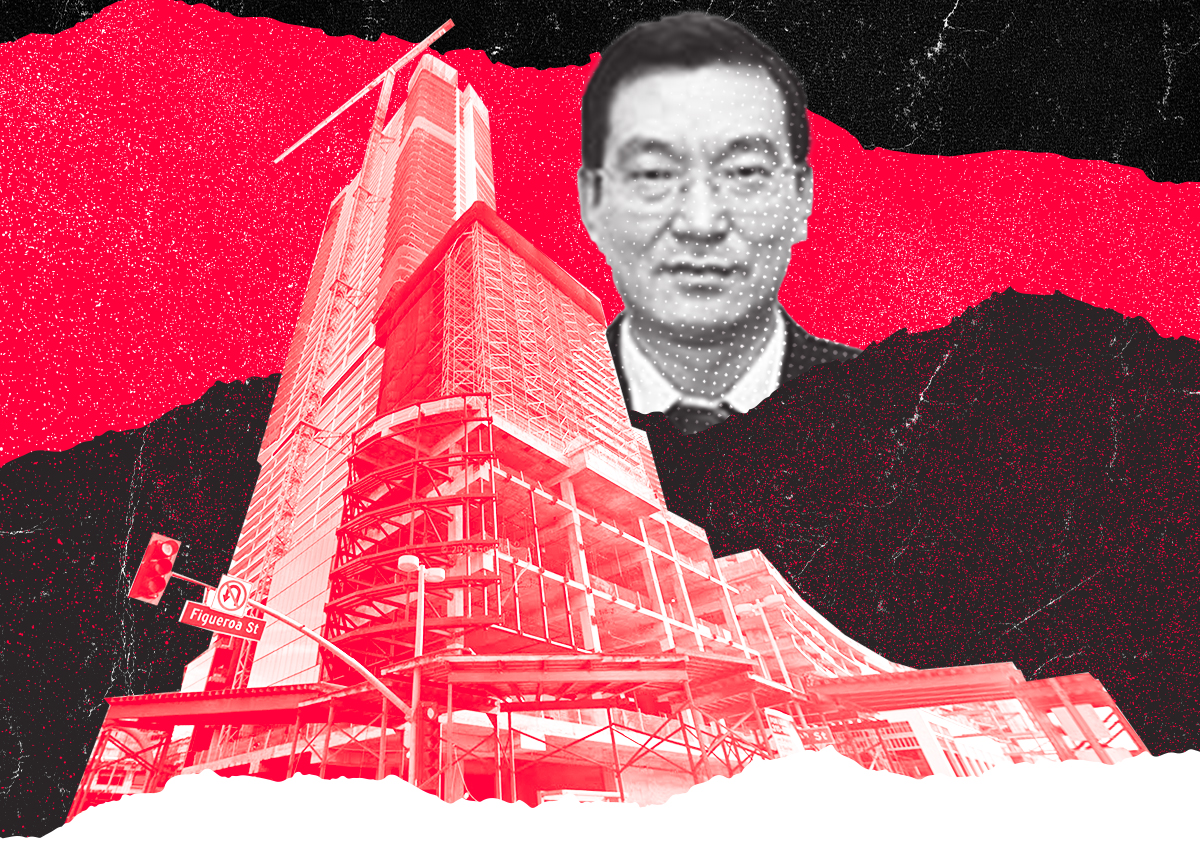

Adam Rubin, who runs Carolwood, offered the notion that his firm’s deal for the AON Center — a bargain by historic standards on a building that has long been a prominent plank of Downtown L.A.’s skyline — “gave people a guidepost.”

“Before that, nobody knew — everyone was saying, ‘When is someone going to make a deal?’” he said.

The question came amid a drastic downturn last year.

Investors spent $2.5 billion buying offices across L.A. last year, down 51 percent from 2022 and 63 percent from 2019, according to Newmark.

Fewer trades means fewer comparables — and if you don’t know how much other people are willing to spend on offices, how do you know what to pay?

And while it’s difficult to paint broad strokes across every submarket, those three sales across L.A. are a good starting indicator that at least some of L.A.’s office hubs are seeing deals as low as they can go.

“The first wave of trades are just starting to come through to speak to new and reset pricing,” said Paul Miszkowicz, a principal at Harbor Associates. “But many want to see additional trades.”

Comps to come

At the end of last year, Brookfield Properties listed 777 Tower in Downtown L.A. for sale.

The investment firm, which had defaulted on $319 million in loans tied to the 52-story tower at 777 South Figueroa Street, started collecting bids this year, according to sources familiar with the matter.

Brookfield got at least 15 offers on the tower, according to sources. Brookfield declined to comment. The property is 52 percent leased, which could be a deterrent for some.

Any sale is likely to close at less than half of Brookfield’s debt on the building. One source estimated it would close between $145 and $150 a square foot — up to $150 million in total.

Every square foot of occupied space adds value to a building, according to Rubin. The difference between being 50-percent leased and 60-percent leased can make or break a deal — that extra 10 percent occupancy can add $50 a square foot on the price.

At the moment, investors should be underwriting for 50 to 60 percent occupancy, not 90 to 95 percent occupancy, as they could have before the pandemic, according to Skip Kessler, an attorney at Greenberg Glusker.

“It’s unrealistic to think they can fill it,” Kessler said.

And the properties that are fully occupied and well-performing — what Shannon called “the best stuff” — are “probably not coming to market,” he said.

For example, office landlords in Century City, the Westside office hub, where rents are at all-time highs and vacancy rates are about 10 percentage points lower than the overall L.A. market, are holding onto their properties.

“The sales are concentrated in the Bs and Cs,” Shannon said.

Some towers traditionally classified as Class A, including 777 Tower, have been forced to come to market after the sellers faced debt issues. In these cases, lenders have been, behind closed doors, pushing owners to make a deal, according to sources familiar with the matter.

And some of those Class A towers in Downtown L.A. need upgrades and ultimately, a landlord willing to put money into the property.

A landlord that gets in at a low enough basis can do that.

“At the end of the day, Downtown L.A. is a major value play compared to Century City,” Rubin said.

Market by market play

While some investors are comfortable toying with the idea that L.A.’s office market has hit bottom, not everyone is a believer.

Right now, the bargain-hunting tied to the notion that a floor has been set is the province for local entrepreneurs, family offices and other sources of patient money.

“When you speak to institutional capital, a lot of them are more weary of the office product type and more weary that prices have declined meaningfully,” Miszkowicz said. “Opportunistic buyers — they’re getting comfortable investing.”

Any office buyer right now is likely either a high net-worth individual or family office, who might not have to rely on traditional acquisition financing to go through with a deal. Potentially, they could go in with all cash.

The buyer pool for offices has been the same for at least six months now. Institutional groups have backed away from purchases, leaving the door open for non-traditional buyers.

Miszkowicz said there’s more “conviction” on certain types of product or within certain submarkets, adding Harbor was getting more comfortable investing in more suburban-oriented properties with small to medium-sized tenants.

He’s avoiding the Fortune 500 tenants.

“There’s a larger degree of uncertainty on what their office space needs look like moving forward,” he said.

He’s also not convinced that Downtown L.A. has hit bottom yet — it might have a fair way to go.

“There needs to be additional data points on trades,” Miszkowicz said. “And the B and C product have a long road to recovery. You really need to be a sharpshooter.”

The post Good news/bad news: LA’s office market finds bottom appeared first on The Real Deal.